Homeowners Insurance in and around Orange

Looking for homeowners insurance in Orange?

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

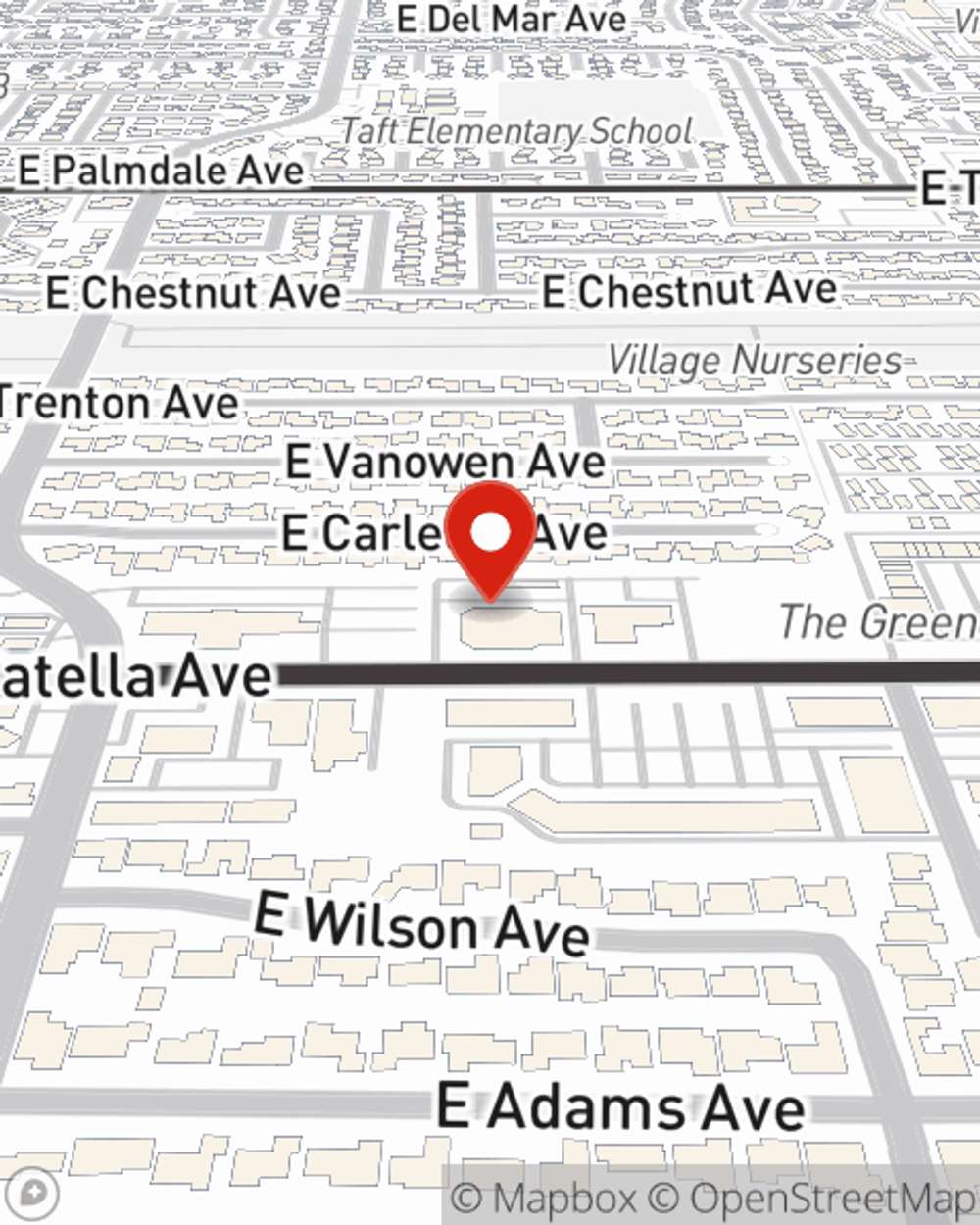

You have plenty of options when it comes to choosing a home insurance provider in Orange. Sorting through deductibles and providers isn’t easy. But if you want competitive priced homeowners insurance, choose State Farm. Your friends and neighbors in Orange enjoy remarkable value and no-nonsense service by working with State Farm Agent Adriana Mora. That’s because Adriana Mora can walk you through the whole insurance process, step by step, to help ensure you have coverage for your home as well as jewelry, sound equipment, linens, mementos, and more!

Looking for homeowners insurance in Orange?

Give your home an extra layer of protection with State Farm home insurance.

Homeowners Insurance You Can Trust

With this great coverage, no wonder more homeowners prefer State Farm as their home insurance company over any other insurer. Agent Adriana Mora would love to help you choose the right level of coverage, just visit them to get started.

For outstanding protection for your home and your valuables, check out the coverage options with State Farm. And if you're ready to see how you can save on a home insurance policy, visit State Farm agent Adriana Mora's office today.

Have More Questions About Homeowners Insurance?

Call Adriana at (714) 634-4000 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

What to do after a tornado

What to do after a tornado

The aftermath of a tornado can feel scary and overwhelming. Here's how to address your most urgent needs first, and how to start the tornado recovery process.

Adriana Mora

State Farm® Insurance AgentSimple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

What to do after a tornado

What to do after a tornado

The aftermath of a tornado can feel scary and overwhelming. Here's how to address your most urgent needs first, and how to start the tornado recovery process.